Optofolio Robotic Financial Advisor

Optofolio RFA is a customizable AI platform that can be leveraged by financial institutions to acquire the financial position and risk tolerance of their retail customers through an engaging online conversation, and accordingly recommend them a suitable portfolio tailored to their needs.

We work with our customers to define an effective user journey for each end user profile (e.g. wealth level, technical sophistication, time available). For example, we generally recommend offering a basic Goal-based Robo Advisor for end users with small funds and simple needs, and a more sophisticated Robo Advisor for end users with larger funds and/or more complex needs. of the end user.

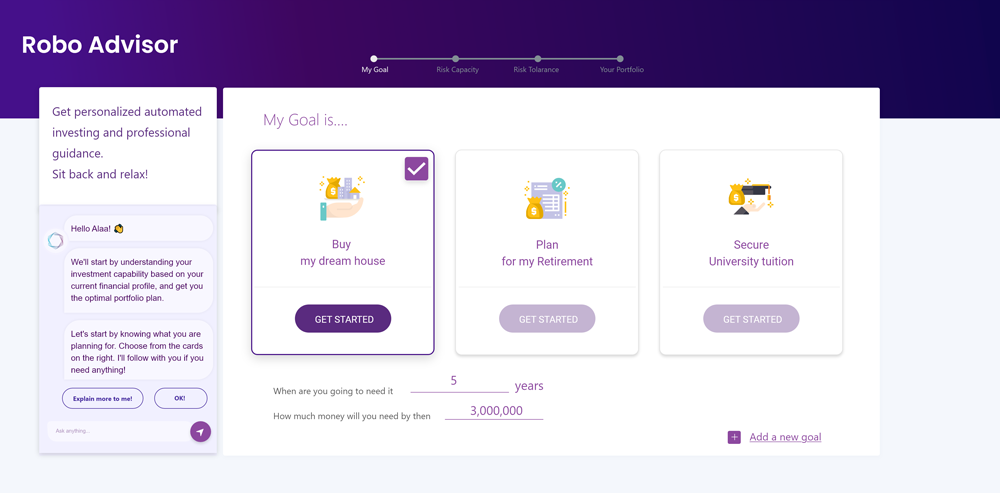

Below are the steps involved in helping a sophisticated user with sufficient level of trust in the organization operating the Robo-Advisor in the financial planning process:

Robotic Financial Advisor Goal Process

Select or Define your Goal

What are your goals for the future? Is is having your dream house, planning for your university tuition or planning for a great retirement?. Optofolio RFA works towards your future goals.

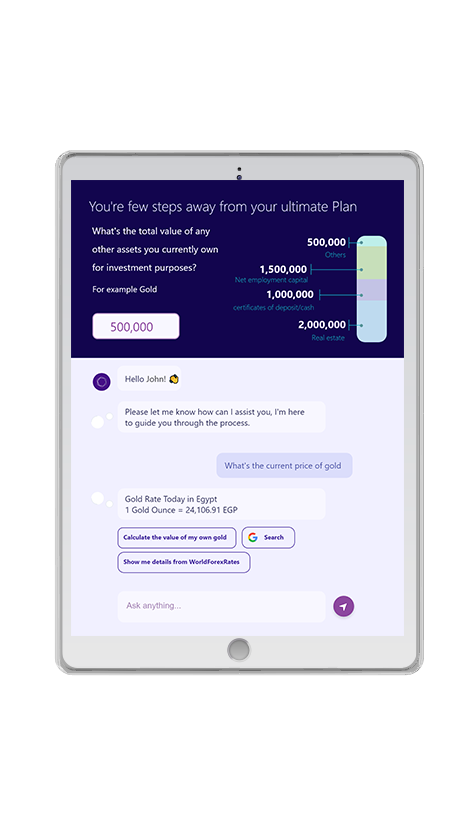

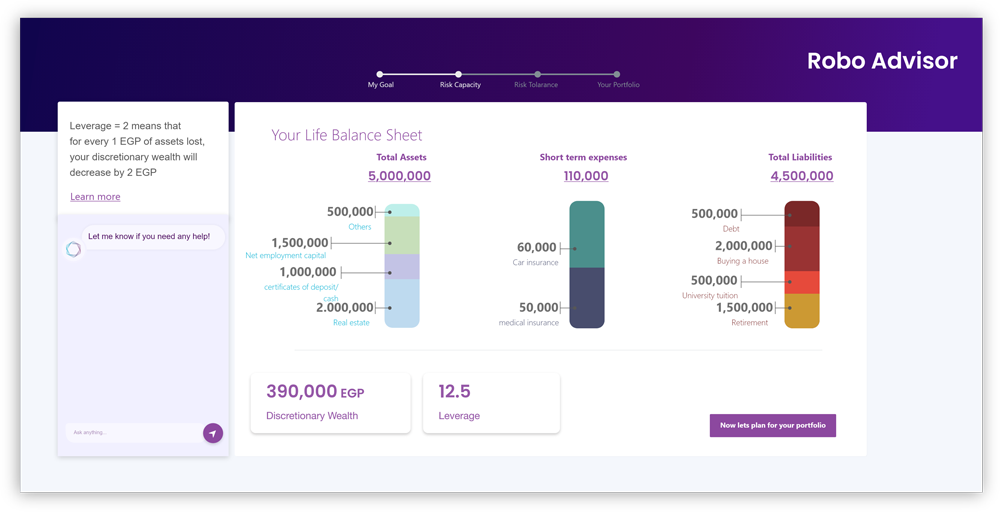

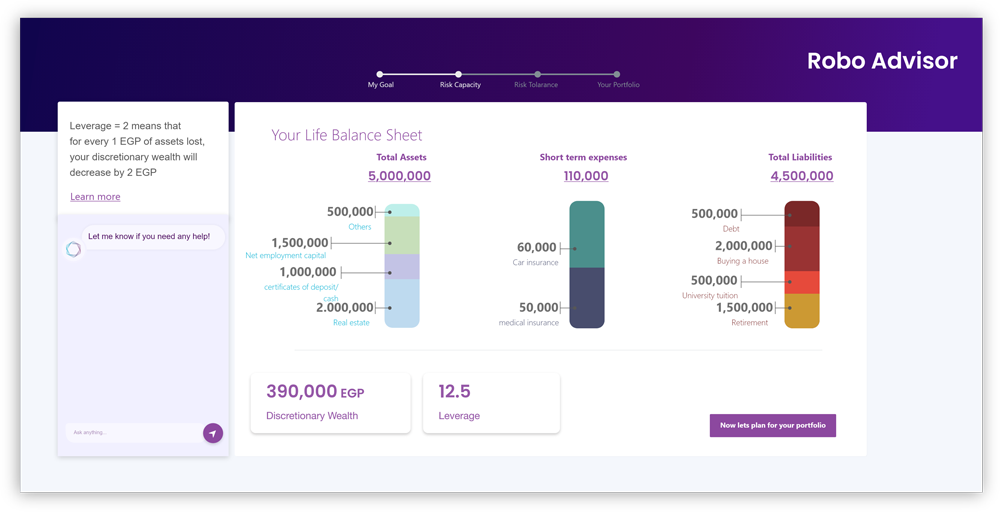

Capture the Financial Position to Measure the Risk Capacity

Users are asked a series of questions to capture an accurate picture of their current financial situation as well as future goals .

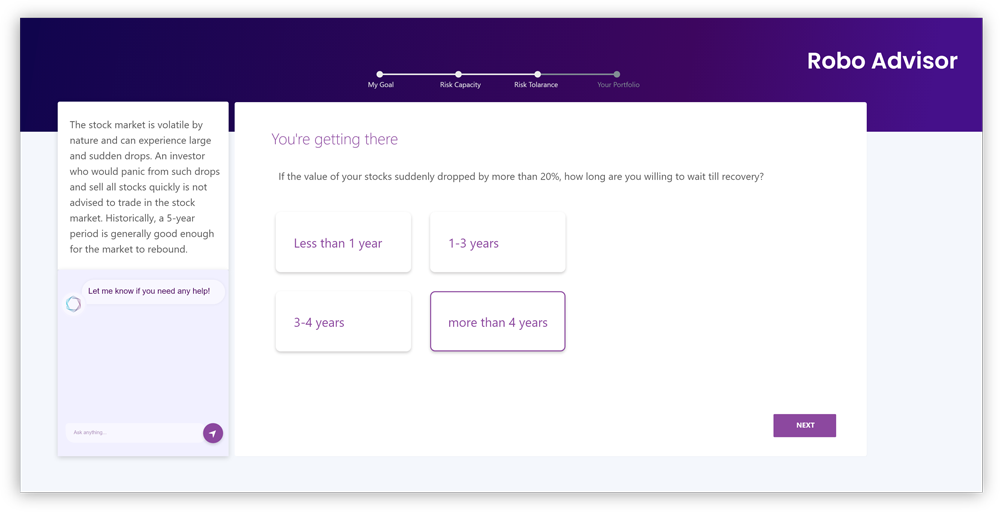

Capture the Risk Tolerance

Users are asked some questions to assess their psychological readiness to deal with volatility. Their risk tolerance level directly impacts the portfolios that are recommended to them; for example a user with very low level of risk tolerance generally cannot handle the highly volatile nature of the stock market.

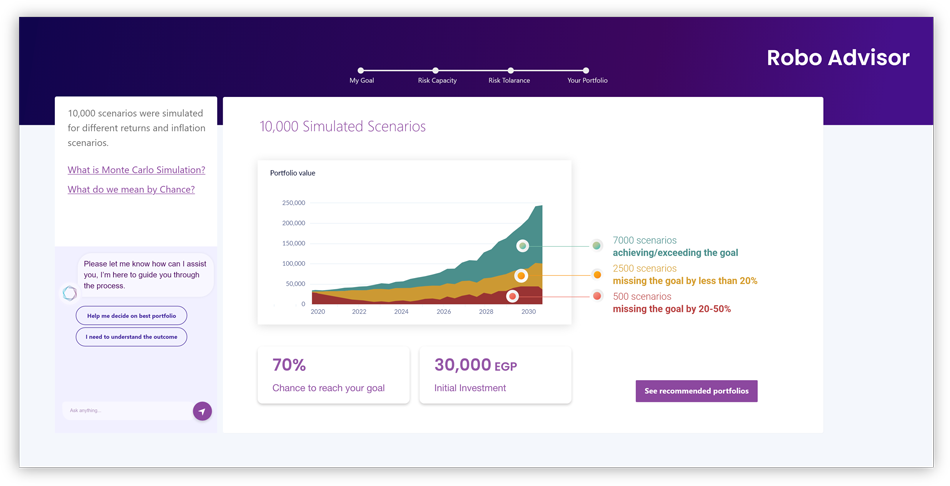

Recommend a Suitable Portfolio for Each Goal

A separate portfolio is recommended for each goal depending on the goal’s importance and time horizon; goals with higher importance and shorter time horizons require more conservative portfolios. Users can see how likely they are to achieve the goal in addition to their downside risk.

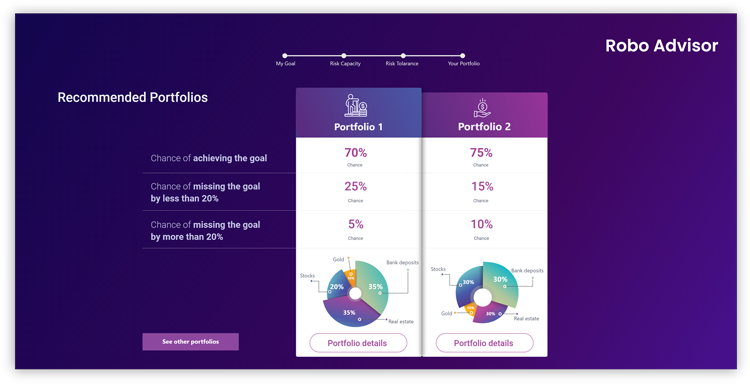

Portfolio Selection & Execution

Users can compare the recommended portfolios against other portfolios and accordingly buy their portfolios of choice.

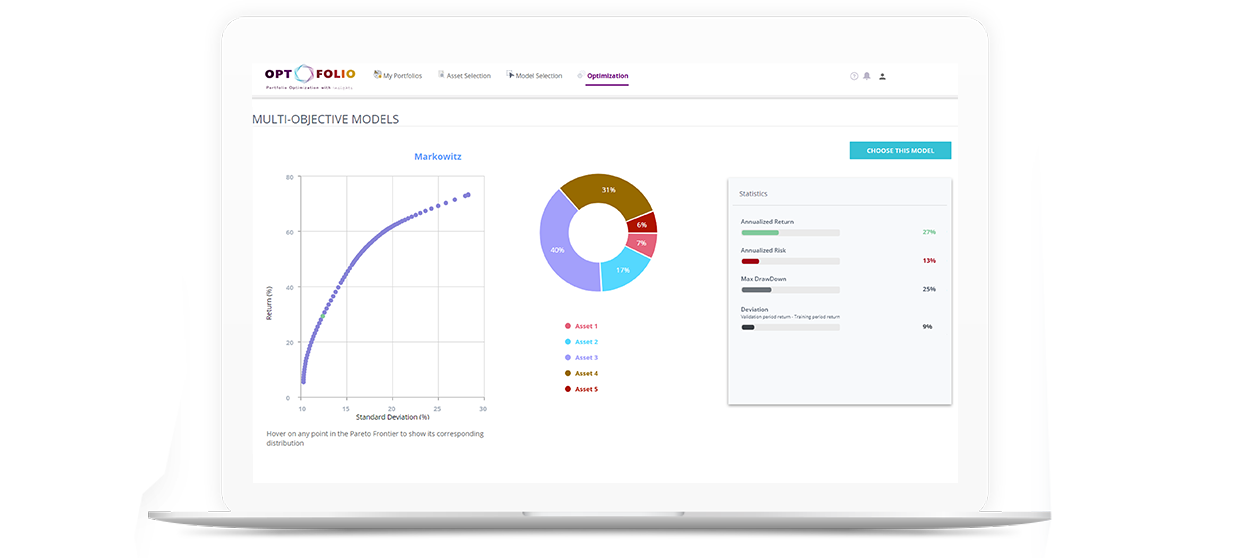

Optofolio Optimizer

Optofolio Optimizer is a flexible platform that can be leveraged by asset managers to construct optimal portfolios matching the business constraints (e.g. available assets, regulations) based on historical data as well as their expectations for the future. Optofolio leverages rich capabilities (e.g. multi objective optimization, monte carlo simulation) to produce an efficient frontier of optimal portfolios suitable for a wide variety of risk profiles.